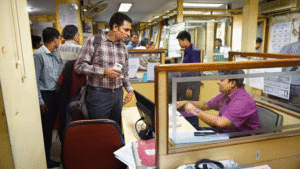

The banking industry is nearing a tipping point. The days when banking meant standing in long lines, filling out forms, and talking face-to-face with a banker are rapidly fading as customers demand a banking system that is focused on their needs and is more technology-driven. With digital banking capabilities growing by leaps and bounds, customers expect speed, security, and convenience from their banks with every transaction.

Digital Banking and Customer Experience

Digitalization has completely transformed the way banks conduct business. Mobile banking applications, online payments, and services available 24/7 are quickly becoming the norm. In the past, when people would include visiting the branch in their schedule for any simple task, their banking system has now evolved to accommodate this.

Customers’ financial transactions with their banks now take place at any time at their convenience on secure mobile or online apps, and in most cases, customers are now able to manage their banking needs in a completely digital manner. In doing so, banks are able to facilitate customers’ needs more quickly and, in turn, increase customer satisfaction rates.

The Role of Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are vital components of our modern banking system. Banks are utilizing technology in real-time banking solutions based on the responses of humans and customers. From chatbots responding to customer inquiries to AI fraud systems, banks are offering services that allow customers to have better access to their finances and provide more security with the speed of service. Personalized financial recommendations are helping customers and clients make better money decisions based on data and metrics. Automation implemented through back-office procedures reduces mistakes and decreases costs.

Cybersecurity: A Top Priority

As banking shifts online, focus is sharpening evermore on cybersecurity. Banks, and even resource poor startup companies, are funding advanced biometric security systems, blockchain technology, and artificial intelligence (AI) enabled fraud detection. All banks realize that trust is paramount, and protecting customer data is essential to keep bank accounts from becoming liabilities.

Digital Banking and Financial Inclusion

Digital banking can be a source of good: financial inclusion. Whether powered by mobile wallets, digital payment systems, or an online loan application, financial inclusions are expanding access to rural and underserved populations. Financial inclusion provides access to bank accounts and capital, and can help drive economic growth and uplift people, companies, and communities.